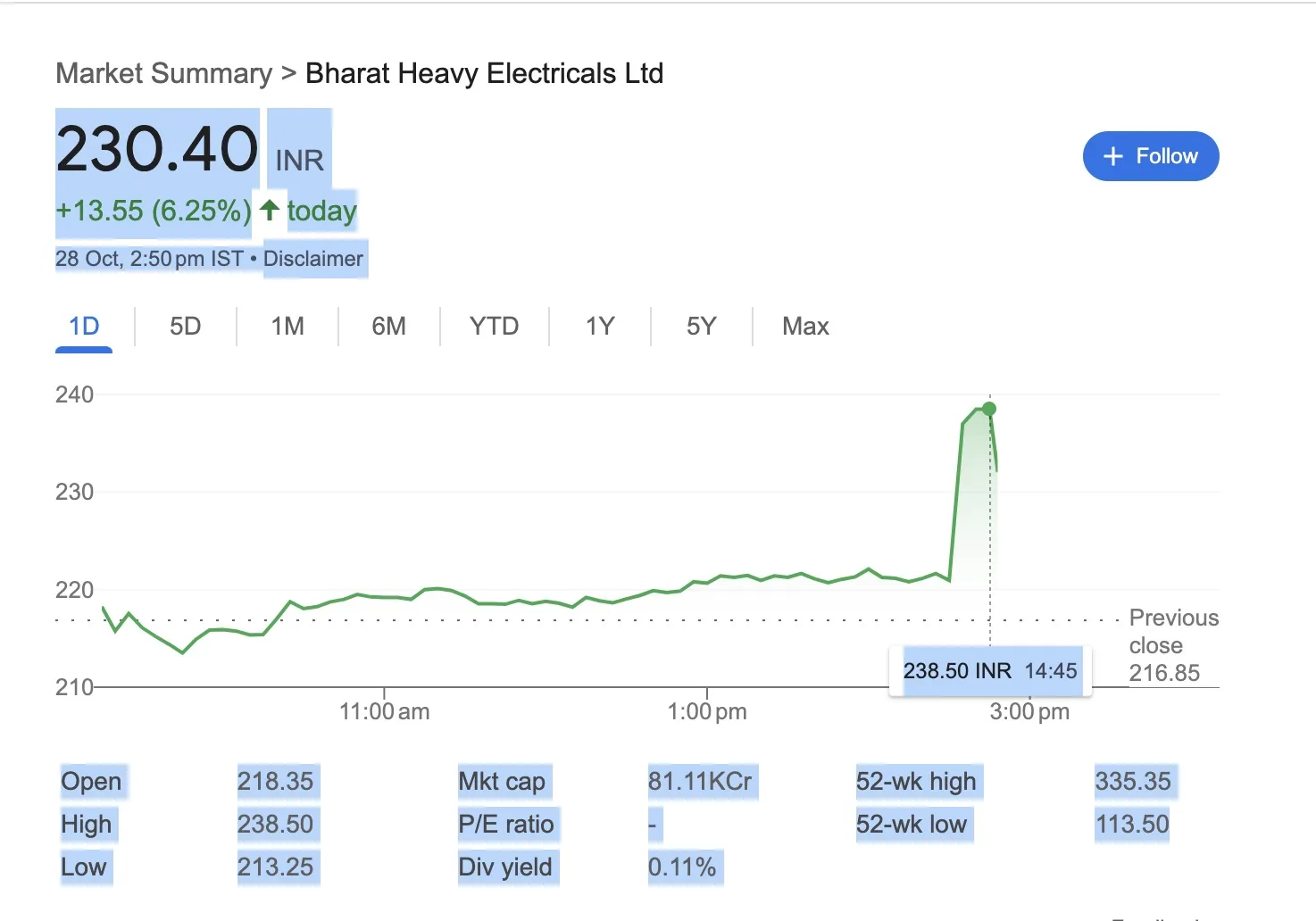

Today, on October 28, BHEL shares have shown a strong upward trend, currently trading at ₹232.20 with a gain of 7.08% (as of 2:48 PM IST). Despite a recent downtrend, today’s market has shown positive momentum.

Key Stock Details (October 28, 2024)

- Opening Price: ₹218.35

- Day’s High: ₹238.50

- Day’s Low: ₹213.25

- Market Cap: ₹81,110 crore

- P/E Ratio: Not Available

- Dividend Yield: 0.11%

- 52-Week High: ₹335.35

- 52-Week Low: ₹113.50

Recent Performance and Expert Opinion

On October 25, BHEL shares dropped by 4.22%, closing at ₹217.70. Experts have advised against fresh buying in this stock, while those who already own it are recommended to hold, with a stop-loss in place. Analysts suggest that the stock could potentially fall further, and if it drops below ₹211, it may reach down to ₹205.

Stock Performance Overview

| Period | Return (%) |

|---|---|

| 6 Months | -19.85% |

| 1 Year | 87.19% |

| 5 Years | 327.28% |

| Long Term | 1,129% |

| YTD | 9.87% |

Summary Table

| Description | Details |

|---|---|

| Company Name | Bharat Heavy Electricals Limited (BHEL) |

| Current Price (Oct 28, 2024) | ₹232.20 |

| Opening Price | ₹218.35 |

| Day’s High | ₹238.50 |

| Day’s Low | ₹213.25 |

| Market Cap | ₹81,110 crore |

| P/E Ratio | Not Available |

| Dividend Yield | 0.11% |

| 52-Week High | ₹335.35 |

| 52-Week Low | ₹113.50 |

| 6-Month Return | -19.85% |

| 1-Year Return | 87.19% |

| 5-Year Return | 327.28% |

| Long Term Return | 1,129% |

| YTD Return | 9.87% |

| Expert Advice | Hold with stop-loss monitoring |

Disclaimer: Investments in mutual funds and the stock market carry risks. Consult your financial advisor before investing.