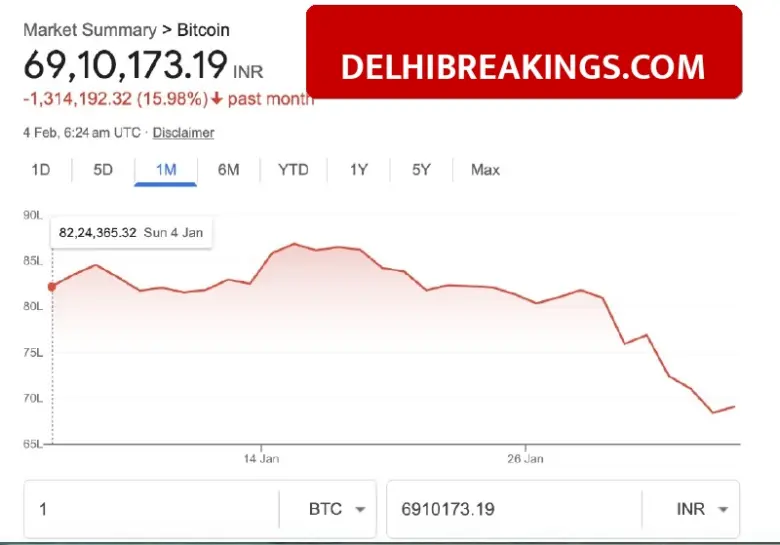

Bitcoin prices have taken a sharp turn downwards, hitting levels not seen since the election results in November 2024. On February 4, 2026, the value dipped to an intraday low of $72,877. This drop marks a significant shift as the profits made during the 2025 rally have been largely erased. Investors are watching closely as the market faces high volatility.

Why is the crypto market falling suddenly?

Several major global events are causing this sudden drop in prices. The nomination of Kevin Warsh as the Federal Reserve Chair has created fear that interest rate cuts might be delayed. Investors generally prefer lower interest rates for assets like crypto.

Additionally, geopolitical tensions between the U.S. and Iran have pushed people towards safer investments like gold. The ongoing trade tariffs on China are also adding to the nervous sentiment in the financial markets.

How much value has been lost?

The recent crash has wiped out a huge amount of money from the market. In less than a week, nearly $470 billion disappeared from the total cryptocurrency market capitalization. Approximately $2.56 billion in leveraged positions were liquidated in just 24 hours.

| Data Point | Details |

|---|---|

| Current Price | ~$76,200 (Feb 4, 2026) |

| Recent Low | $72,877 |

| Peak Price (Oct 2025) | $126,000+ |

| Total Drop from Peak | ~40% |

| Market Cap Loss | $470 Billion |

What is the status of the Trump Trade?

The rally known as the “Trump trade” appears to have reversed completely. Bitcoin is now down about 40% from its all-time high of over $126,000 which was reached in October 2025. The price even broke a major support level of $74,424 that was set back in April 2025.

While retail investors seem fearful, reports suggest that some big institutional players like ARK Invest are still buying during this dip. However, the general market mood remains extremely cautious right now.